Blockchain technology has emerged as one of the most revolutionary innovations in recent years, particularly within the realm of finance. Its potential to reshape financial systems is immense, providing enhanced security, transparency, and efficiency. As the financial world continues to evolve, understanding the role of blockchain in modern financial systems is crucial for businesses, financial institutions, and regulators. In this article, we will explore the impact of blockchain technology on financial systems, how it is being integrated into various financial services, and the future implications of its adoption.

Introduction to Blockchain Technology

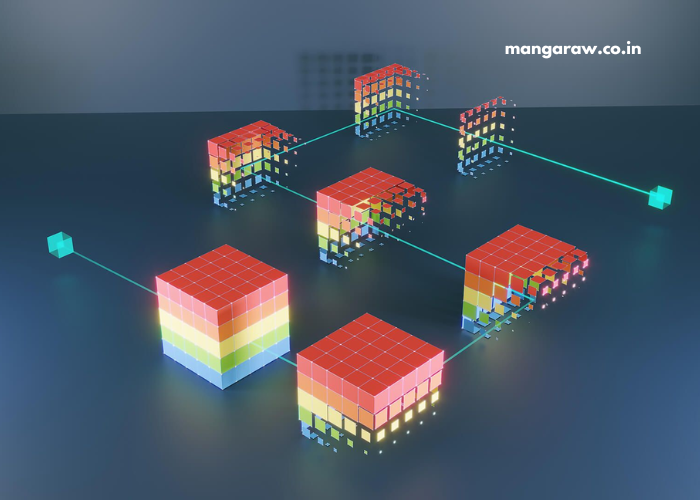

Blockchain is a decentralized digital ledger technology that records transactions across a network of computers in a secure, transparent, and immutable way. Each “block” in a blockchain contains a list of transactions, and once a block is filled with data, it is appended to the previous block, forming a chain. The decentralized nature of blockchain ensures that no single entity has control over the data, making it resistant to tampering and fraud.

While blockchain was initially popularized through cryptocurrencies like Bitcoin, its applications go far beyond digital currencies. Blockchain’s ability to provide secure, transparent, and tamper-proof record-keeping has made it an appealing solution for various industries, particularly the financial sector.

How Blockchain is Transforming the Financial Sector

The financial sector is one of the primary industries benefiting from the adoption of blockchain technology. Traditional financial systems are often burdened by inefficiencies such as slow transaction speeds, high costs, and vulnerability to fraud. Blockchain offers a solution by providing a more efficient, transparent, and secure alternative.

1. Enhancing Security and Reducing Fraud

One of the key advantages of blockchain in financial systems is its ability to enhance security and reduce the risk of fraud. Blockchain’s decentralized and transparent nature makes it difficult for malicious actors to alter or tamper with transaction data. Each transaction is cryptographically verified by multiple participants in the network, ensuring its authenticity. This makes blockchain an ideal solution for securing financial transactions, reducing the risk of fraud and cyberattacks.

2. Faster and Cheaper Transactions

Traditional financial systems often involve multiple intermediaries, which can slow down the transaction process and increase costs. Blockchain eliminates the need for intermediaries, allowing for peer-to-peer transactions that are faster and more cost-effective. For example, cross-border payments, which can take several days and incur high fees, can be completed within minutes on a blockchain network at a fraction of the cost. This has significant implications for both businesses and consumers, as it reduces the time and money spent on financial transactions.

3. Transparency and Auditability

Blockchain’s transparency is another key feature that makes it attractive to the financial industry. Since every transaction is recorded on a public ledger that is accessible to all participants, blockchain provides a high level of accountability. Financial institutions can use blockchain to enhance transparency in their operations, ensuring that transactions are traceable and auditable. This can help reduce the risk of financial misconduct and improve trust in the financial system.

4. Smart Contracts and Automation

Smart contracts are self-executing contracts with the terms of the agreement directly written into code. These contracts automatically execute when certain conditions are met, eliminating the need for intermediaries and reducing the risk of human error. In the financial sector, smart contracts can be used to automate various processes, such as loan origination, insurance claims, and securities trading. This not only improves efficiency but also reduces costs and enhances the accuracy of transactions.

Blockchain Use Cases in Financial Services

Blockchain technology has found a wide range of applications in financial services, from payments and lending to insurance and asset management. Below are some of the key use cases of blockchain in the financial sector.

1. Cross-Border Payments

Cross-border payments have long been a challenge for financial institutions due to issues such as high fees, long processing times, and currency exchange complexities. Blockchain technology offers a solution by enabling real-time, low-cost cross-border payments. Platforms like Ripple and Stellar use blockchain to facilitate fast and affordable international transfers, enabling businesses and individuals to send money across borders without relying on traditional intermediaries.

2. Digital Currencies and Central Bank Digital Currencies (CBDCs)

Cryptocurrencies like Bitcoin and Ethereum have gained widespread attention in recent years, but their volatility and regulatory uncertainty have limited their mainstream adoption. Central Bank Digital Currencies (CBDCs), however, are gaining traction as a way for governments to leverage blockchain technology for national currencies. Unlike cryptocurrencies, CBDCs are issued and regulated by central banks, providing stability while maintaining the benefits of blockchain, such as transparency and security. Several countries, including China and Sweden, are already experimenting with CBDCs, and others are likely to follow suit.

3. Decentralized Finance (DeFi)

Decentralized Finance (DeFi) is a rapidly growing sector within blockchain technology that aims to create an open, permissionless financial system. DeFi platforms enable individuals to access financial services, such as lending, borrowing, and trading, without the need for traditional intermediaries like banks or brokers. By using blockchain and smart contracts, DeFi platforms offer users greater control over their financial assets and the ability to participate in financial markets without relying on centralized institutions.

4. Trade Finance and Supply Chain Management

Blockchain has the potential to revolutionize trade finance and supply chain management by providing a secure and transparent way to track goods as they move through the supply chain. Blockchain can be used to create digital trade documents, such as letters of credit and bills of lading, that are tamper-proof and easily traceable. This reduces the risk of fraud and errors in the trade process, improving efficiency and reducing costs for businesses engaged in international trade.

5. Securities and Asset Management

Blockchain can also streamline securities trading and asset management by providing a transparent and immutable ledger of ownership. Traditional securities trading often involves complex and time-consuming processes, with multiple intermediaries involved in verifying transactions. By using blockchain, financial institutions can automate the settlement process and reduce the time it takes to finalize trades. Additionally, blockchain can enable fractional ownership of assets, allowing for greater liquidity and access to investment opportunities for retail investors.

Challenges of Implementing Blockchain in Financial Systems

While the potential benefits of blockchain in financial systems are significant, there are several challenges that must be addressed before widespread adoption can occur.

1. Regulatory Uncertainty

The regulatory environment surrounding blockchain and cryptocurrencies is still evolving, and there is significant uncertainty about how governments will approach the technology. Financial regulators around the world are grappling with issues such as consumer protection, anti-money laundering (AML) regulations, and taxation in the context of blockchain-based transactions. Clear and consistent regulatory frameworks are essential for enabling the mainstream adoption of blockchain technology in financial systems.

2. Scalability Issues

Blockchain networks, particularly those using Proof of Work (PoW) consensus mechanisms like Bitcoin, face scalability challenges when it comes to processing a large number of transactions. While blockchain can handle a relatively small volume of transactions quickly and securely, the technology needs to be able to scale to accommodate the demands of a global financial system. Solutions like Proof of Stake (PoS) and Layer 2 scaling solutions, such as the Lightning Network, are being developed to address these scalability concerns.

3. Integration with Legacy Systems

Many financial institutions still rely on legacy systems that are not compatible with blockchain technology. Integrating blockchain with these systems can be complex and costly. Financial institutions must invest in infrastructure upgrades and employee training to ensure that they can effectively leverage blockchain technology. Additionally, the interoperability between different blockchain networks and traditional financial systems is a key challenge that must be addressed.

4. Security and Privacy Concerns

While blockchain is considered secure, it is not immune to threats. For instance, 51% attacks, where a single entity gains control of a majority of the network’s mining power, can compromise the security of blockchain networks. Moreover, the transparency of blockchain transactions can raise concerns about privacy, particularly in the context of financial data. Solutions like zero-knowledge proofs and private blockchains are being explored to address these issues.

The Future of Blockchain in Financial Systems

Despite the challenges, the future of blockchain in financial systems is promising. As the technology matures and regulatory frameworks are established, blockchain is expected to play an increasingly important role in the financial sector. Key developments to watch for include:

1. Widespread Adoption of CBDCs

Central Bank Digital Currencies (CBDCs) are likely to become a significant part of the global financial landscape in the coming years. Governments are exploring the use of blockchain to issue digital currencies that can enhance financial inclusion, improve payment efficiency, and reduce reliance on traditional banking systems.

2. Greater Integration with Traditional Financial Institutions

As blockchain technology becomes more mainstream, we can expect to see greater integration between blockchain and traditional financial institutions. Banks and other financial institutions are likely to adopt blockchain-based solutions to streamline their operations, reduce costs, and improve security. This integration will help bridge the gap between the traditional financial world and the emerging blockchain ecosystem.

3. Expansion of DeFi Platforms

Decentralized Finance (DeFi) is expected to continue growing, with more individuals and institutions seeking alternatives to traditional financial services. DeFi platforms are likely to become more sophisticated, offering a wider range of services and attracting greater liquidity. However, regulatory challenges and security concerns will need to be addressed to ensure the long-term success of the DeFi sector.

Conclusion

Blockchain technology is transforming modern financial systems by offering solutions to some of the most pressing challenges facing the industry today, including inefficiencies, security risks, and a lack of transparency. By providing a decentralized, secure, and transparent alternative to traditional financial systems, blockchain has the potential to reshape the way financial transactions are conducted. While there are still challenges to overcome, the future of blockchain in finance is bright, and its impact is likely to be felt across the industry in the coming years.

As blockchain continues to evolve, financial institutions, regulators, and businesses must stay informed about the technology’s potential and prepare for its widespread adoption. By embracing blockchain, the financial sector can unlock new opportunities for innovation, efficiency, and growth, ultimately leading to a more secure and inclusive global financial system.